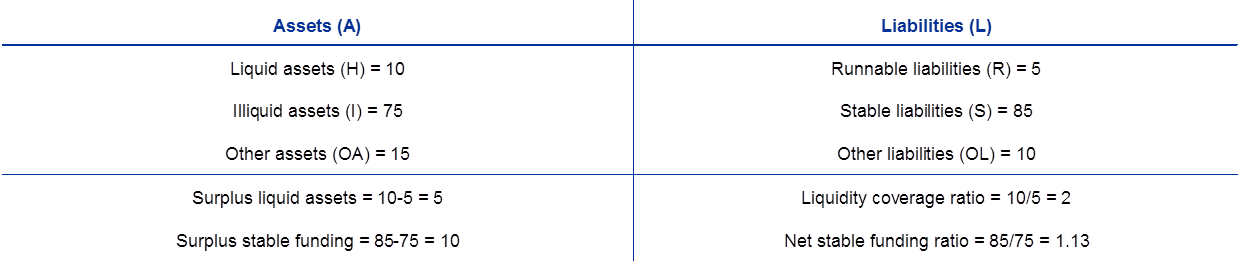

Sidi C #0Doubt on Twitter: "The higher their "high Liq asset" in their portfolio, the better the bank is positioned! "The Liquidity Coverage Ratio (LCR) requires banks to have sufficient high-quality liquid

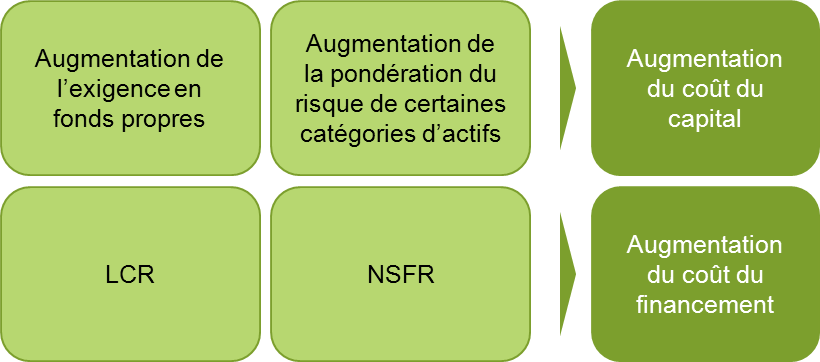

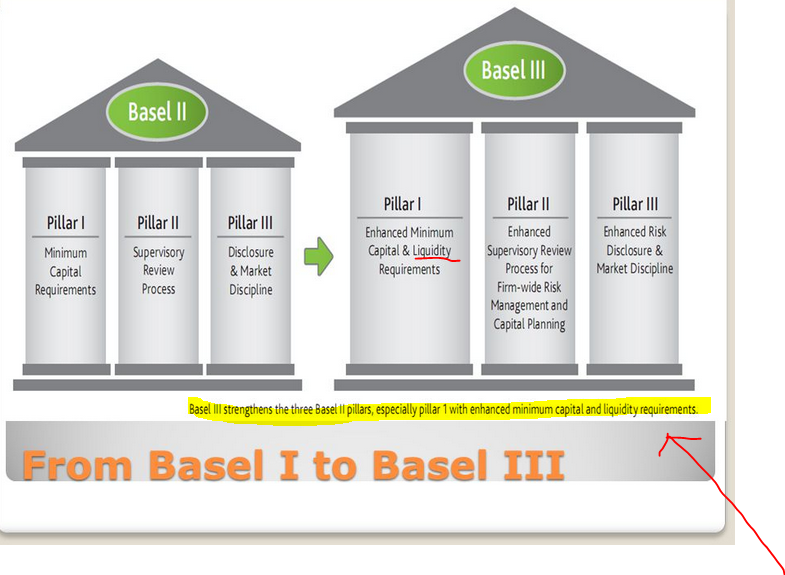

Architecture de Bâle III Les nouveautés de Bâle III se présentent, en... | Download Scientific Diagram

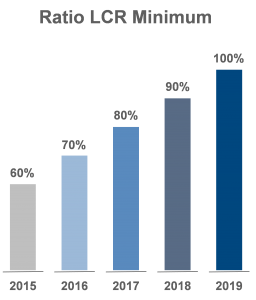

Regulatory Consistency Assessment Programme (RCAP) - Assessment of Basel III LCR regulations - United States of America

Consultant fonctionnel - reporting réglementaire Bâle 3 / ratios de liquidité LCR/NSFR | eFinancialCareers

Impact of the Liquidity Coverage Ratio (LCR) Requirement on EMEAP Money Markets, Central Bank Operations and Monetary Policy Tra